(3) | As of December 31, 2021, there were 12,642,188 shares available for grant under the 2021 Plan and 1,900,000

(1)Represents the 2021 Plan and the Instructure Holdings, Inc. 2021 Employee Stock Purchase Plan (the “ESPP”). As of December 31, 2023, the number of shares reserved for issuance under the 2021 Plan and the ESPP were 29,346,306 shares and 4,736,576 shares, respectively, subject to adjustments in the event of a stock split, stock dividend or other change in our capitalization. The number of shares reserved for issuance under the 2021 Plan automatically increases each January 1, by 4% of the outstanding number of shares of our common stock on the immediately preceding December 31, or such lesser amount of shares as determined by the Board. The total number of shares reserved for issuance under the ESPP increases annually on January 1 ending in 2031 by a number of shares of our common stock equal to 1% of the total number of shares of our common stock outstanding on December 31 of the preceding calendar year, or such lesser number of shares as determined by the Board. As of December 31, 2023, there were approximately 105,236 shares of common stock subject to purchase under the ESPP for the offering period that ended on February 29, 2024. The shares of common stock underlying any awards that are forfeited, cancelled, held back upon exercise or settlement of an award to satisfy the exercise price or tax withholding, reacquired by us prior to vesting, satisfied without the issuance of stock, expire or are otherwise terminated, other than by exercise, under the 2021 Plan are added back to the shares of common stock available for issuance under such plan. (2)Represents 4,790,155 RSUs granted and unvested under the 2021 Plan as of December 31, 2023. RSUs do not have an exercise price. (3)As of December 31, 2023, there were 19,683,951 shares available for grant under the 2021 Plan and 4,018,556 shares available for grant under the ESPP.

Pay Versus Performance The following table sets forth certain information with respect to the Company’s financial performance and the compensation paid to our NEOs for the fiscal years ended on December 31, 2023, December 31, 2022, December 31, 2021 and December 31, 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Value of Initial Fixed $100

Investment Based On: | | | | | | | | | Year | | | Summary

Compensation

Table Total for

PEO ($)(1) | | | | Compensation

Actually Paid to

PEO ($)(1)(2) | | | | Average Summary

Compensation Table

Total for Non-PEO

NEOs ($)(3) | | | | Average

Compensation

Actually Paid to

Non-PEO

NEOs ($)(3)(2) | | | | Total Shareholder

Return(4) | | | | Peer Group

Total Shareholder

Return(4) | | | | Net Income(5) | | | | Company Selected Metric Adjusted

EBITDA (6) | | | 2023 | | | | 6,400,555 | | | | | 8,490,922 | | (7) | | | 4,393,659 | | | | | 3,819,066 | | (7) | | $ | 129 | | | | $ | 109 | | | | $ | (34,078,056 | ) | | | | 214,213,000 | | | 2022 | | | | 4,432,093 | | | | | 3,862,026 | | (8) | | | 2,588,259 | | | | | 2,589,310 | | (8) | | $ | 112 | | | | $ | 67 | | | | | (34,242,414 | ) | | | | 179,591,000 | | | 2021 | | | | 5,604,570 | | | | | 16,680,361 | | (9) | | | 1,899,106 | | | | | 3,718,637 | | (9) | | $ | 114 | | | | $ | 103 | | | | | (88,677,584 | ) | | | | 146,678,000 | | | 2020 | | | | 11,742,154 | | | | | 13,607,284 | | (10) | | | 3,537,300 | | | | | 4,031,384 | | (10) | | $ | — | | | | $ | — | | | | | (177,981,299 | ) | | | | 66,325,000 | | |

(1)The name of the Principal Executive Officer of the Company (“PEO”) reflected in these columns for each of the applicable fiscal years is our CEO, Steve Daly. (2)In calculating the ‘compensation actually paid’ amounts reflected in these columns, the fair value or change in fair value, as applicable, of the equity award adjustments included in such calculations was computed in accordance with FASB ASC Topic 718. The valuation assumptions used to calculate such fair values did not materially differ from those disclosed at the time of grant. (3)The names of each of the non-PEO NEOs reflected in these columns for 2023 are as follows: Peter Walker, Chris Ball, Matthew Kaminer and Mitch Benson. The names of each of the non-PEO NEOs reflected in these columns for 2022, 2021, and 2020 are as follows: Dale Bowen, Matthew Kaminer, Frank Maylett and Mitch Benson. (4)The Company Total Shareholder Return (“TSR”) and the Company’s Peer Group TSR reflected in these columns for each applicable fiscal year is calculated based on a fixed investment of $100 at the applicable measurement point on the same cumulative basis as is used in Item 201(e) of Regulation S-K. The peer group used to determine the Company’s Peer Group TSR for each applicable fiscal year is the following published industry index, as disclosed in our Annual Report on Form 10-K pursuant to Item 201(e) of Regulation S-K: S&P 1500 Application Software Index. (5)Represents the amount of net income reflected in the Company’s audited GAAP financial statements for each applicable fiscal year. (6)We have selected Adjusted EBITDA as our most important financial measure (that is not otherwise required to be disclosed in the table) used to link ‘compensation actually paid’ to our NEOs to company performance for fiscal year 2023. Adjusted EBITDA is defined as earnings before debt-related costs, including interest and loss on debt extinguishment, benefit for taxes, depreciation, and amortization, adjusted to exclude certain items of a significant or unusual nature, including stock-based compensation, transaction costs, sponsor costs, impairment charges, other non-recurring costs, effects of foreign currency translation gains and losses, amortization of acquisition-related intangibles, and the impact of fair value adjustments to acquire unearned revenue relating to the Take-Private Transaction and Certica, Impact, and Elevate Data Sync acquisitions. Adjusted EBITDA is a non-GAAP financial measure. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 for a reconciliation to net loss, its most directly comparable U.S. GAAP financial measure. (7)For fiscal year 2023, the ‘compensation actually paid’ to the PEO and the average ‘compensation actually paid’ to the non-PEO NEOs reflect each of the following adjustments made to the total compensation amounts reported in the Summary Compensation Table for fiscal year 2023, computed in accordance with Item 402(v) of Regulation S-K:

| | | | | | | | | | | PEO ($) | | | Average Non-PEO NEOs ($) | | Total Compensation Reported in 2023 Summary Compensation Table | | | 6,400,555 | | | | 4,393,659 | | Less, Grant Date Fair Value of Stock Awards Reported in the 2023 Summary Compensation Table | | | (5,651,951 | ) | | | (3,786,212 | ) | Plus, Year-End Fair Value of Awards Granted in 2023 that are Outstanding and Unvested | | | 4,696,499 | | | | 3,316,725 | | Plus, Change in Fair Value of Awards Granted in Prior Years that are Outstanding and Unvested (From Prior Year-End to Year-End) | | | 1,245,966 | | | | 106,288 | | Plus, Vesting Date Fair Value of Awards Granted in 2023 that Vested in 2023 | | | 1,031,958 | | | | 134,658 | | Plus, Change in Fair Value of Awards Granted in Prior Years that Vested in 2023 (From Prior Year-End to Vesting Date) | | | 767,896 | | | | 99,786 | | Less, Prior Year-End Fair Value of Awards Granted in Prior Years that Failed to Vest in 2023 | | | — | | | | (445,838 | ) | Plus, Dollar Value of Dividends or other Earnings Paid on Stock Awards in 2023 prior to Vesting (if not reflected in the fair value of such award or included in Total Compensation for 2023) | | | — | | | | — | | Total Adjustments | | | 2,090,367 | | | | (574,593 | ) | Compensation Actually Paid for Fiscal Year 2023 | | | 8,490,922 | | | | 3,819,066 | |

(8)For fiscal year 2022, the ‘compensation actually paid’ to the PEO and the average ‘compensation actually paid’ to the non-PEO NEOs reflect each of the following adjustments made to the total compensation amounts reported in the Summary Compensation Table for fiscal year 2022, computed in accordance with Item 402(v) of Regulation S-K:

| | | | | | | | | | | PEO ($) | | | Average Non-PEO NEOs ($) | | Total Compensation Reported in 2022 Summary Compensation Table | | | 4,432,093 | | | | 2,588,259 | | Less, Grant Date Fair Value of Stock & Option Awards Reported in the 2022 Summary Compensation Table (i) | | | (3,615,406 | ) | | | (1,581,740 | ) | Plus, Year-End Fair Value of Awards Granted in 2022 that are Outstanding and Unvested | | | 4,012,553 | | | | 1,665,594 | | Plus, Change in Fair Value of Awards Granted in Prior Years that are Outstanding and Unvested (From Prior Year-End to Year-End) | | | (290,021 | ) | | | (44,364 | ) | Plus, Vesting Date Fair Value of Awards Granted in 2022 that Vested in 2022 | | | — | | | | 85,461 | | Plus, Change in Fair Value of Awards Granted in Prior Years that Vested in 2022 (From Prior Year-End to Vesting Date) | | | (677,192 | ) | | | (123,899 | ) | Less, Prior Year-End Fair Value of Awards Granted in Prior Years that Failed to Vest in 2022 | | | — | | | | — | | Plus, Dollar Value of Dividends or other Earnings Paid on Stock & Option Awards in 2022 prior to Vesting (if not reflected in the fair value of such award or included in Total Compensation for 2022) | | | — | | | | — | | Total Adjustments | | | (570,067 | ) | | | 1,051 | | Compensation Actually Paid for Fiscal Year 2022 | | | 3,862,026 | | | | 2,589,310 | |

(9)For fiscal year 2021, the ‘compensation actually paid’ to the PEO and the average ‘compensation actually paid’ to the non-PEO NEOs reflect each of the following adjustments made to the total compensation amounts reported in the Summary Compensation Table for fiscal year 2021, computed in accordance with Item 402(v) of Regulation S-K:

| | | | | | | | | | | PEO ($) | | | Average Non-PEO NEOs ($) | | Total Compensation Reported in 2021 Summary Compensation Table | | | 5,604,570 | | | | 1,899,106 | | Less, Grant Date Fair Value of Stock & Option Awards Reported in the 2021 Summary Compensation Table (i) | | | (4,603,570 | ) | | | (810,031 | ) | Plus, Year-End Fair Value of Awards Granted in 2021 that are Outstanding and Unvested | | | — | | | | — | | Plus, Change in Fair Value of Awards Granted in Prior Years that are Outstanding and Unvested (From Prior Year-End to Year-End) | | | 13,305,660 | | | | 2,195,278 | | Plus, Vesting Date Fair Value of Awards Granted in 2021 that Vested in 2021 | | | — | | | | — | | Plus, Change in Fair Value of Awards Granted in Prior Years that Vested in 2021 (From Prior Year-End to Vesting Date) | | | 2,373,701 | | | | 434,284 | | Less, Prior Year-End Fair Value of Awards Granted in Prior Years that Failed to Vest in 2021 | | | — | | | | — | | Plus, Dollar Value of Dividends or other Earnings Paid on Stock & Option Awards in 2021 prior to Vesting (if not reflected in the fair value of such award or included in Total Compensation for 2021) | | | — | | | | — | | Total Adjustments | | | 11,075,791 | | | | 1,819,531 | | Compensation Actually Paid for Fiscal Year 2021 | | | 16,680,361 | | | | 3,718,637 | |

i.The values reported reflect the modification charge recognized for the Management Incentive Units that were converted into IPO RSUs for financial statement reporting purposes for the 2021 fiscal year in accordance with FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in Note 10 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2021. (10)For fiscal year 2020, the ‘compensation actually paid’ to the PEO and the average ‘compensation actually paid’ to the non-PEO NEOs reflect each of the following adjustments made to the total compensation amounts reported in the Summary Compensation Table for fiscal year 2020, computed in accordance with Item 402(v) of Regulation S-K:

| | | | | | | | | | | PEO ($) | | | Average Non-PEO NEOs ($) | | Total Compensation Reported in 2020 Summary Compensation Table | | | 11,742,154 | | | | 3,537,300 | | Less, Grant Date Fair Value of Stock & Option Awards Reported in the 2020 Summary Compensation Table | | | (11,234,870 | ) | | | (1,798,416 | ) | Plus, Year-End Fair Value of Awards Granted in 2020 that are Outstanding and Unvested | | | 13,100,000 | | | | 2,292,500 | | Plus, Change in Fair Value of Awards Granted in Prior Years that are Outstanding and Unvested (From Prior Year-End to Year-End) | | | — | | | | — | | Plus, Vesting Date Fair Value of Awards Granted in 2020 that Vested in 2020 | | | — | | | | — | | Plus, Change in Fair Value of Awards Granted in Prior Years that Vested in 2020 (From Prior Year-End to Vesting Date) | | | — | | | | — | | Less, Prior Year-End Fair Value of Awards Granted in Prior Years that Failed to Vest in 2020 | | | — | | | | — | | Plus, Dollar Value of Dividends or other Earnings Paid on Stock & Option Awards in 2020 prior to Vesting (if not reflected in the fair value of such award or included in Total Compensation for 2020) | | | — | | | | — | | Total Adjustments | | | 1,865,130 | | | | 494,084 | | Compensation Actually Paid for Fiscal Year 2020 | | | 13,607,284 | | | | 4,031,384 | |

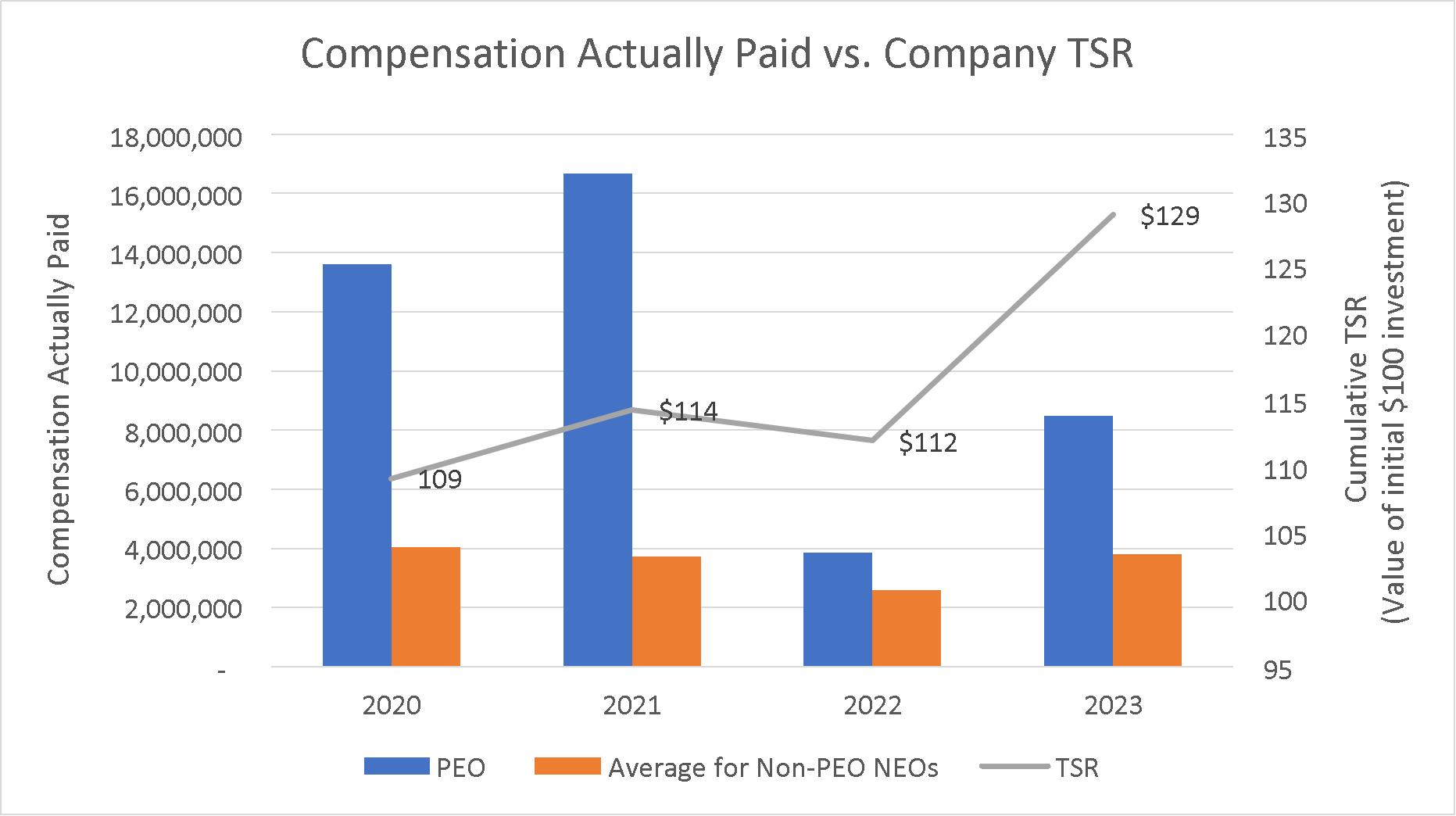

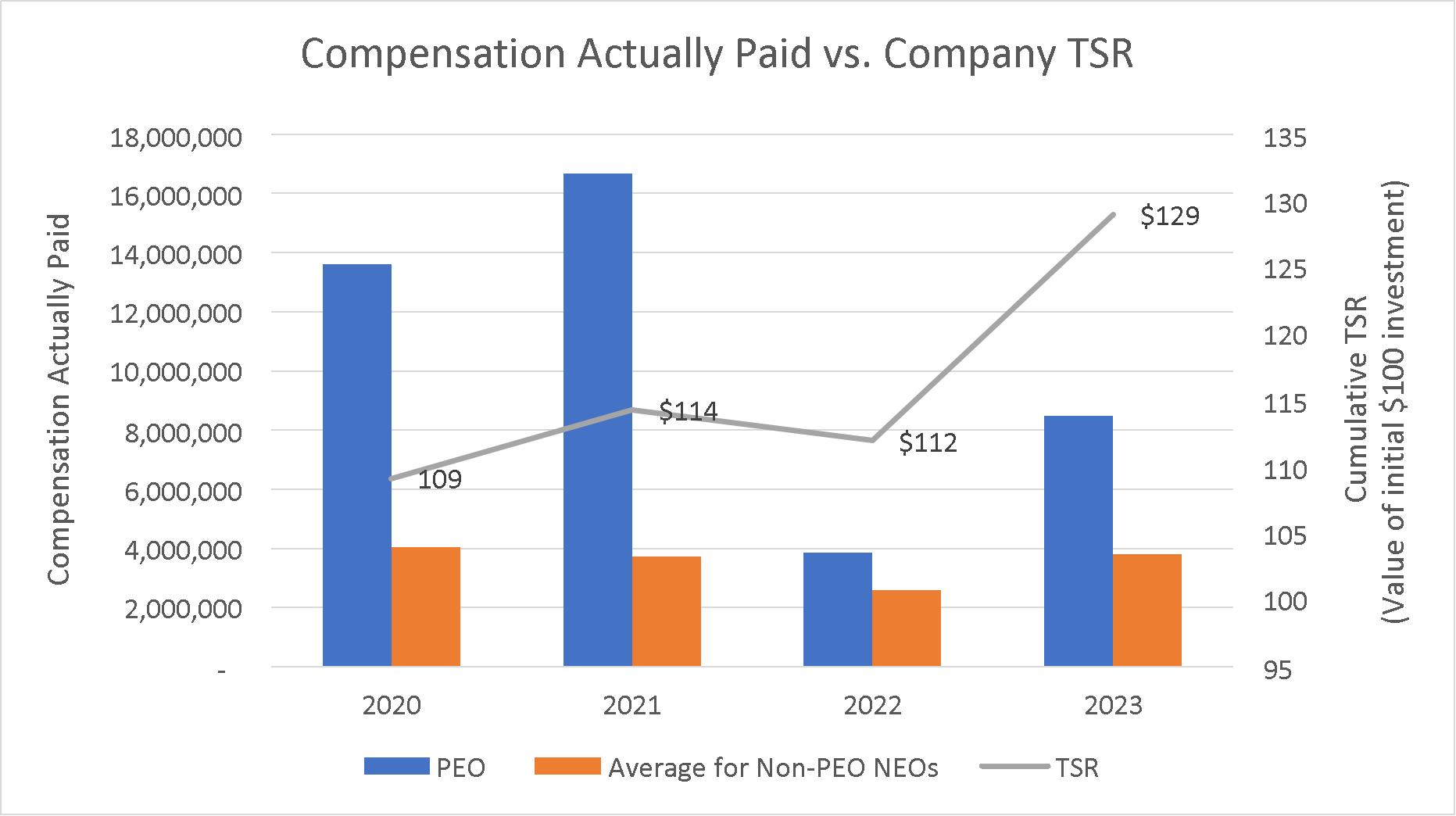

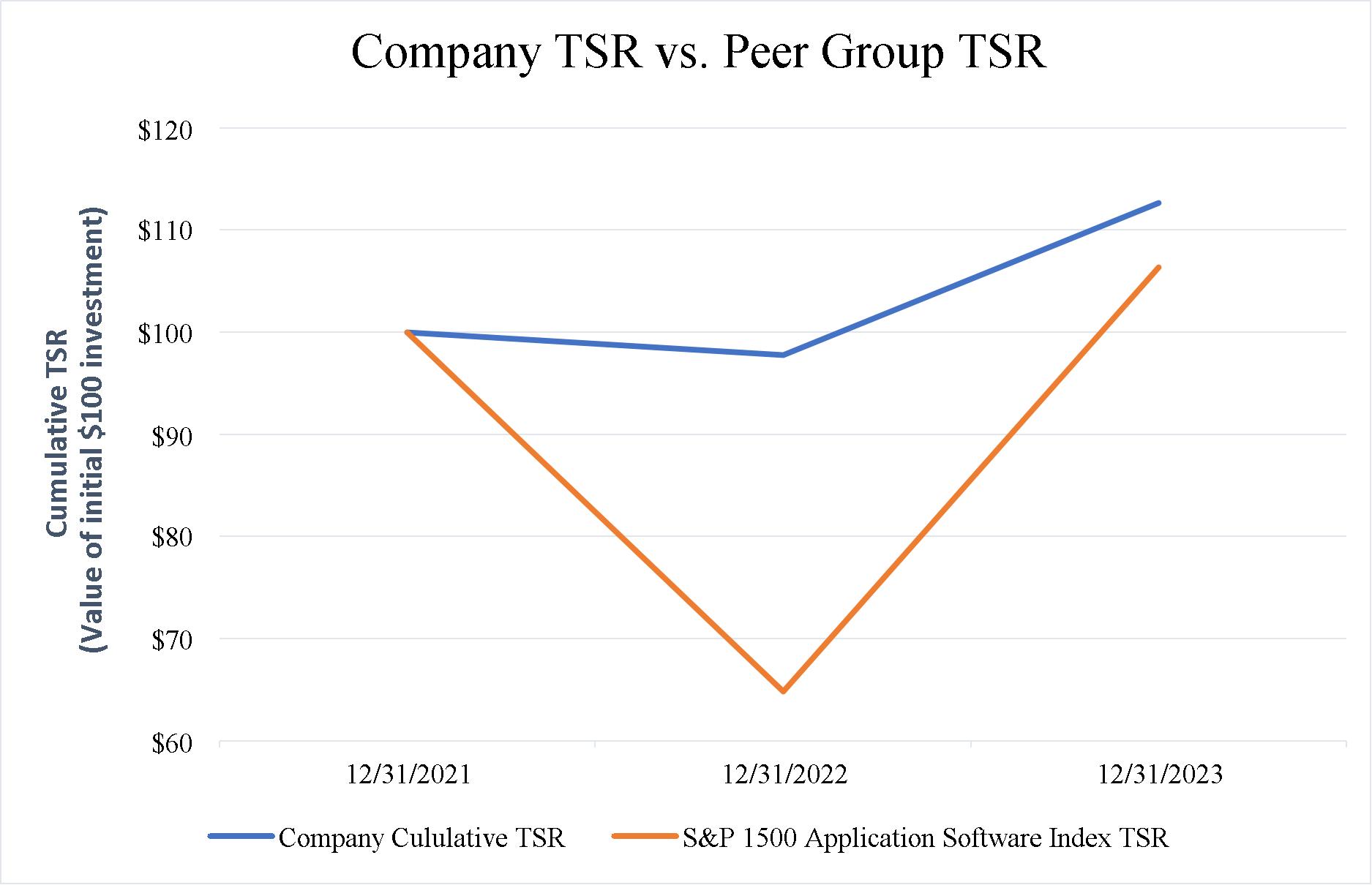

Pay versus Performance Comparative Disclosure Compensation Actually Paid and Company TSR As demonstrated by the following graph, the amount of ‘compensation actually paid�� to the PEO and the average amount of ‘compensation actually paid’ to the non-PEO NEOs is generally aligned with the Company’s TSR over the four years presented in the table. This is because a significant portion of the ‘compensation actually paid’ to the PEO and to the non-PEO NEOs is comprised of equity awards.

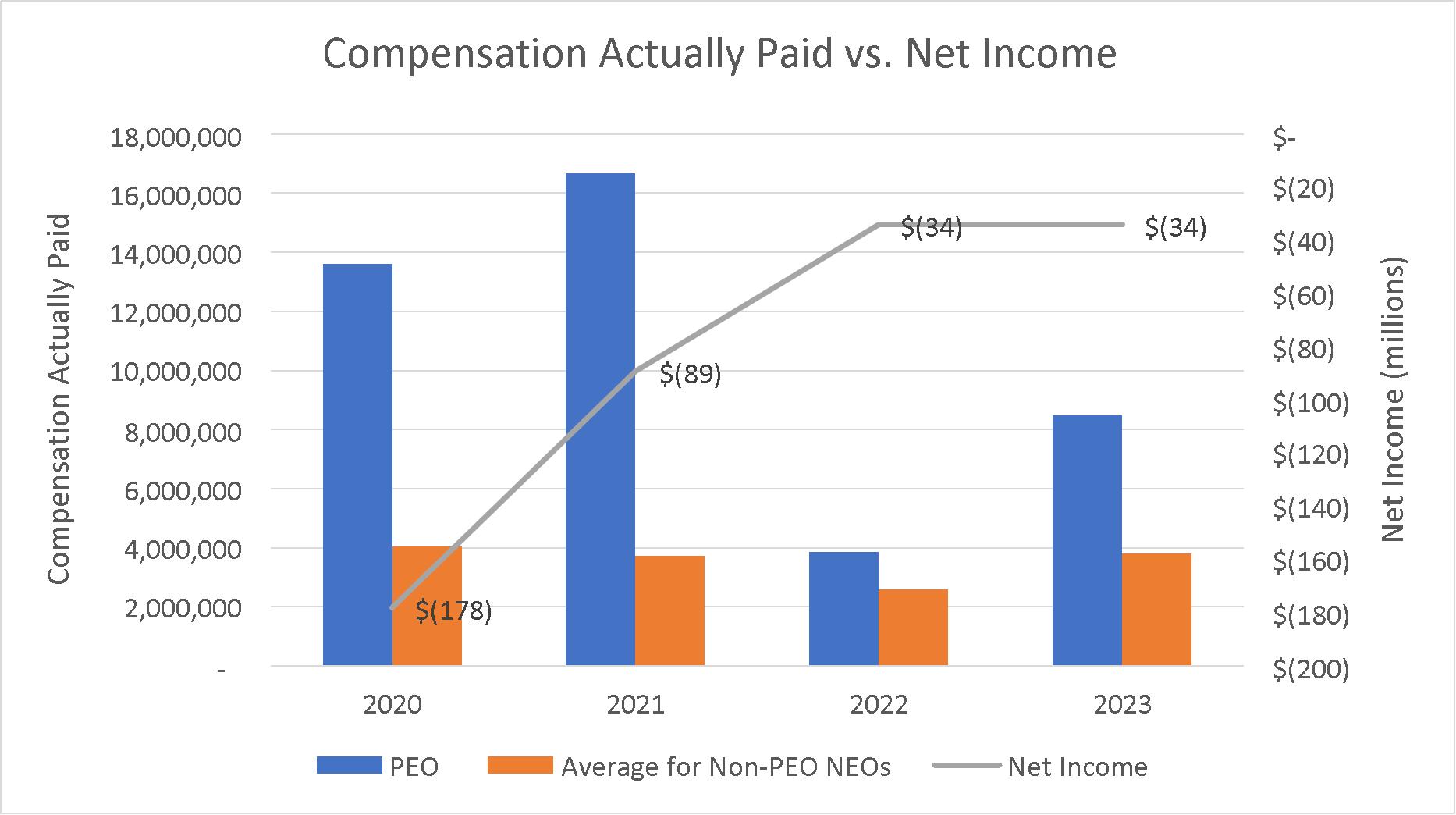

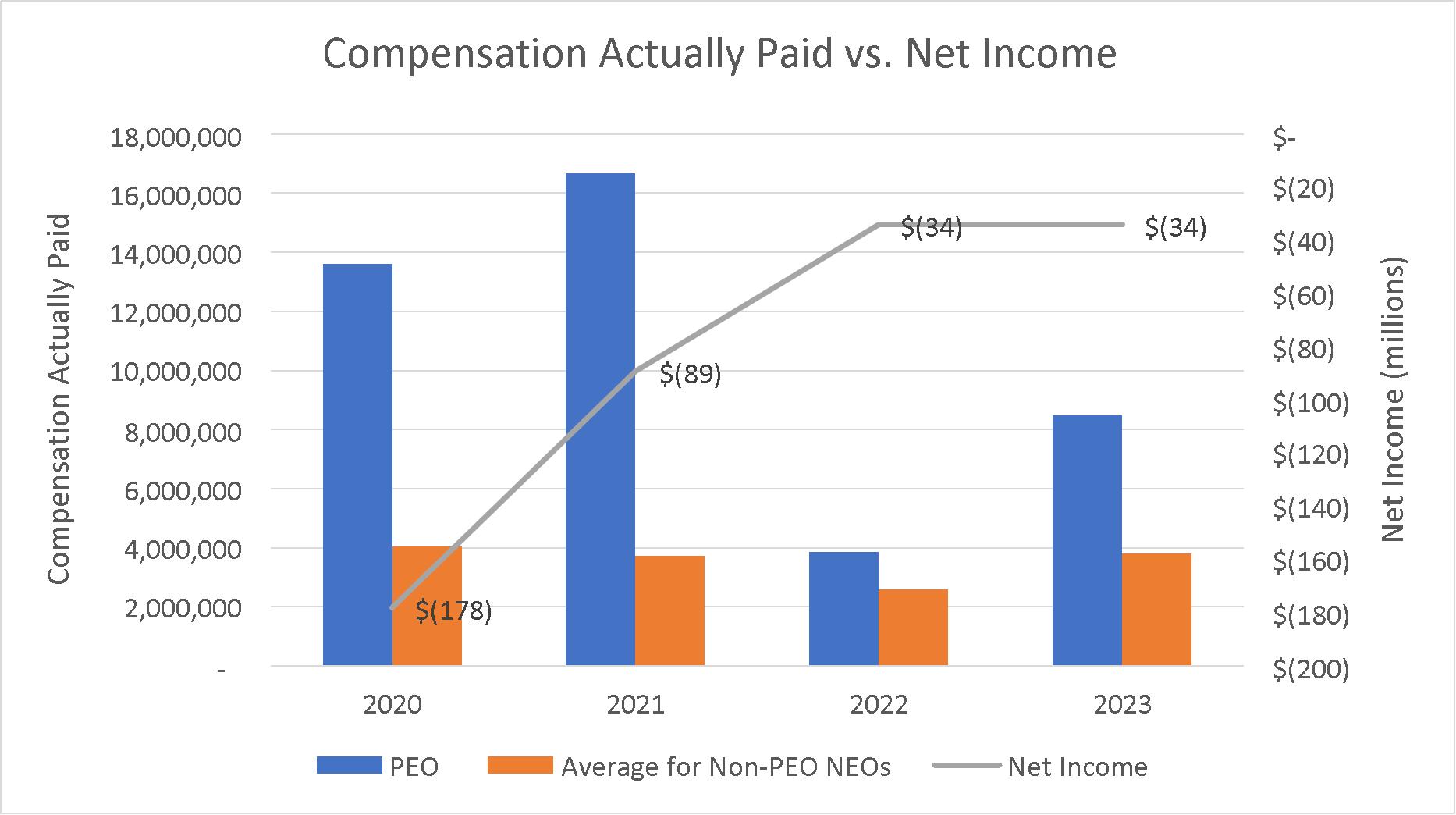

Compensation Actually Paid and Net Income As demonstrated by the following graph, the amount of ‘compensation actually paid’ to the PEO and the average amount of ‘compensation actually paid’ to the non-PEO NEOs is generally aligned with the Company’s net income over the years ended December 31, 2020 and 2021, but is not aligned with the Company's net income for the year ended December 31, 2022. This is because a significant portion of the ‘compensation actually paid’ to the PEO and to the non-PEO NEOs is comprised of equity awards and in 2020 and 2021 the fair value of the awards granted in 2020 substantially increased, whereas there was not a similar increase in 2022. While the Company does not use net income as a performance measure in its overall executive compensation program, the measure of net income is correlated with EBITDA and ARR, which the Company does use when setting goals for the Company’s performance-based cash bonus program.

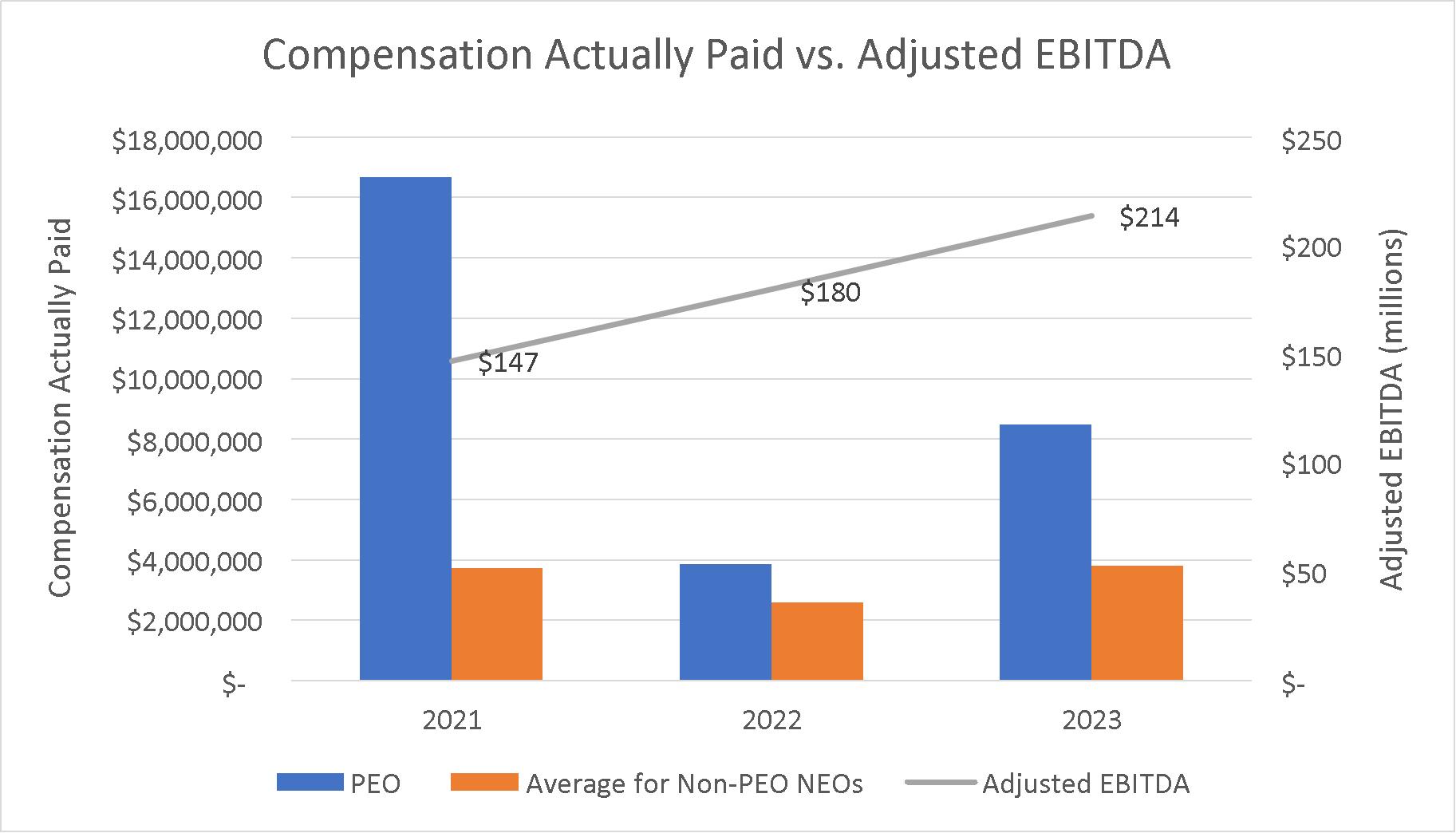

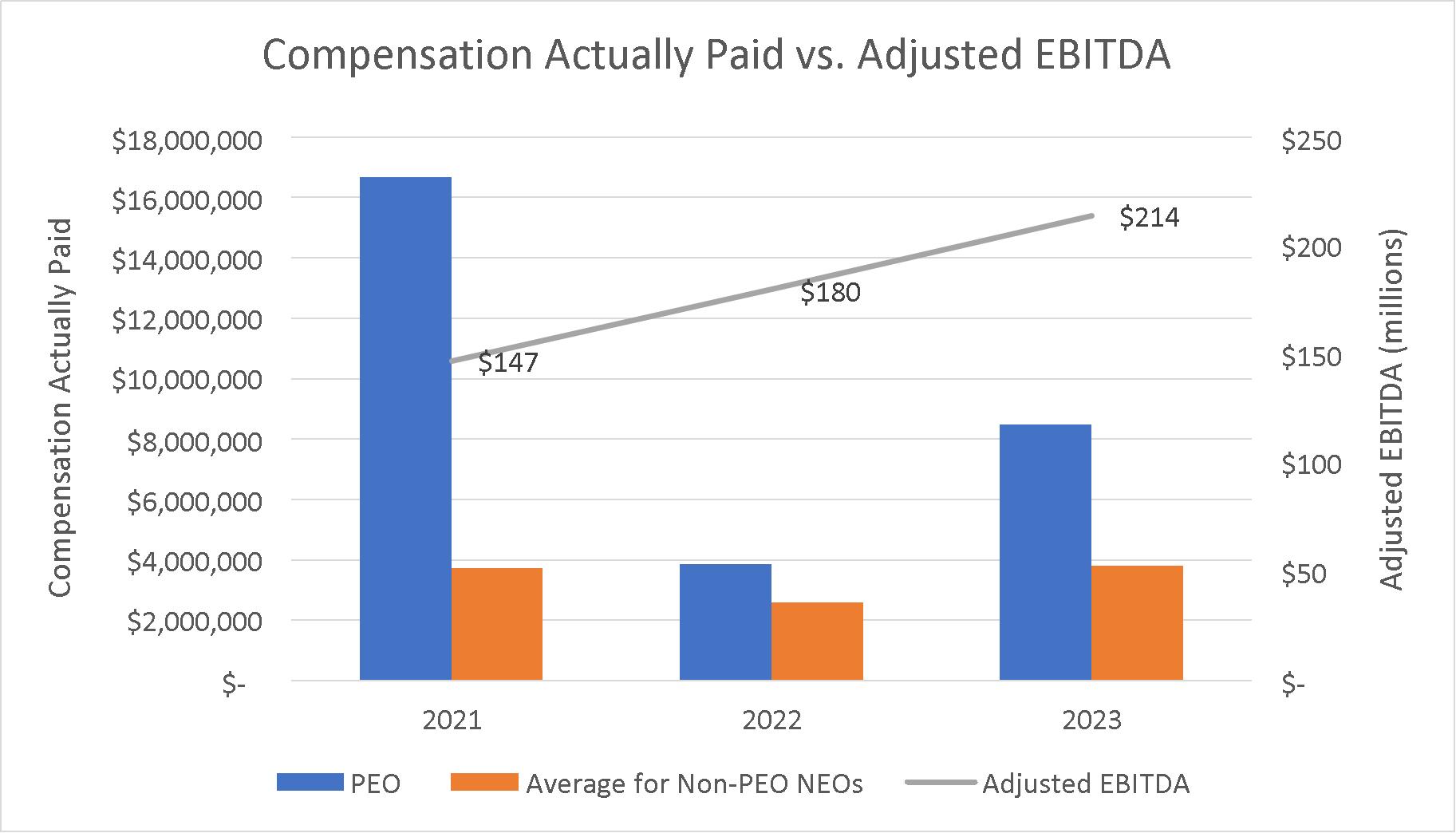

Compensation Actually Paid and Adjusted EBITDA As demonstrated by the following graph, the amount of ‘compensation actually paid’ to the PEO and the average amount of ‘compensation actually paid’ to the non-PEO NEOs is generally aligned with the Company’s Adjusted EBITDA over the years ended December 31, 2020 and 2021, but is not aligned with the Company's net income for the year ended December 31, 2022. This is because a significant portion of the ‘compensation actually paid’ to the PEO and to the non-PEO NEOs is comprised of equity awards and in 2020 and 2021 the fair value of the awards granted in 2020 substantially increased, whereas there was not a similar increase in 2022. As described above, Adjusted EBITDA is defined as earnings before debt-related costs, including interest and loss on debt extinguishment, benefit for taxes, depreciation, and amortization, adjusted to exclude certain items of a significant or unusual nature, including stock-based compensation, transaction costs, sponsor costs, impairment charges, other non-recurring costs, effects of foreign currency translation gains and losses, amortization of acquisition-related intangibles, and the impact of fair value adjustments to acquire unearned revenue relating to the Take-Private Transaction and Certica, Impact, and Elevate Data Sync acquisitions. While the Company uses numerous financial and non-financial performance measures for the purpose of evaluating performance for the Company’s compensation programs, the Company has determined that Adjusted EBITDA is the Company’s most important financial performance measure (that is not otherwise required to be disclosed in the table) used to link ‘compensation actually paid’ to the NEOs to company performance for fiscal year 2022.

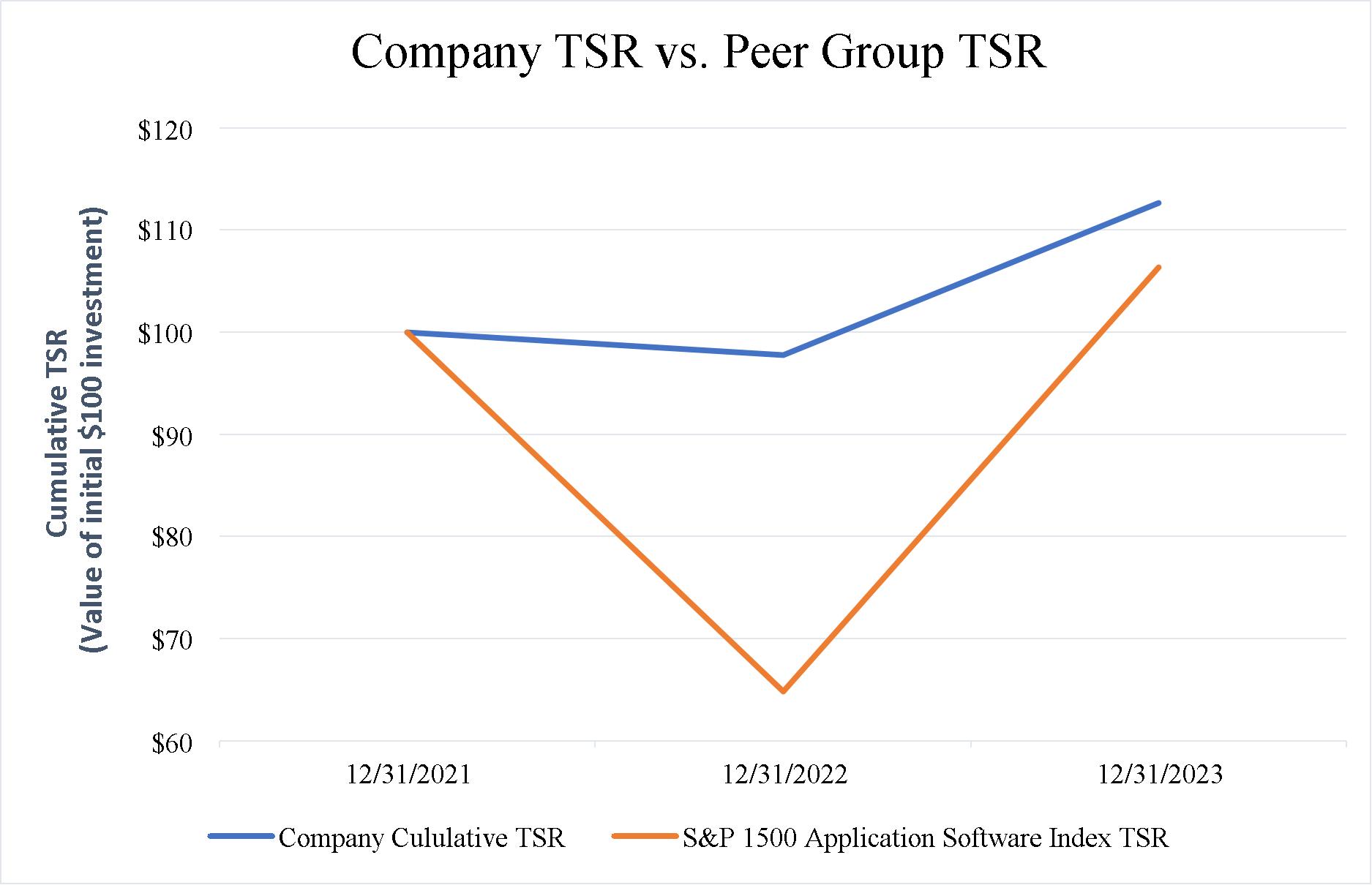

Company TSR and Peer Group TSR As demonstrated by the following graph, the Company’s TSR over the three years presented in the table was 12%, while the Company’s peer group TSR was (33)% over the three years presented in the table. The Company’s TSR generally outperformed the peer group during the three years presented in the table, representing the Company’s superior financial performance as compared to the companies comprising the peer group.

Pay versus Performance Tabular List The following table lists our most important performance measures used by us to link ‘compensation actually paid’ to our NEOs to company performance for fiscal year 2023. The performance measures included in this table are not ranked by relative importance.

| Most Important Performance Measures | Adjusted EBITDA | Annual Recurring Revenue | Adjusted Unlevered Free Cash Flow | Gross Profit |

CEO Pay Ratio As a result of the rules adopted by the SEC under the Dodd-Frank Act, we are required to disclose the ratio of the annual total compensation of our CEO to the annual total compensation of our median employee, using certain permitted methodologies.For fiscal year 2023: •The annual total compensation of the median employee was $94,430; •The annual total compensation of our CEO was $6,400,555; and •The estimated ratio of the annual total compensation of our CEO to the annual total compensation of the median employee was 68 to 1. This pay ratio is a reasonable estimate calculated in a manner consistent with SEC rules based on the methodology described below. The SEC rules for identifying the median compensated employee and calculating the pay ratio allow companies to adopt a variety of methodologies, apply certain exclusions, and make reasonable estimates and assumptions that reflect their compensation practices. As such, the pay ratio reported by other companies may not be comparable to the pay ratio reported above, as other companies may utilize different methodologies, exclusions, estimates, and assumptions in calculating their own pay ratios. Methodology We used December 31, 2023 (the “Determination Date”) as the date to determine the median employee. We examined the total amount of compensation as reflected in our payroll records (“Total Compensation”) for all individuals, excluding our CEO, who were employed by us on the Determination Date. Total Compensation was calculated using the same methodology we used for our NEOs as set forth in the “Summary Compensation Table”. We included all employees, whether employed on a full-time, part-time, seasonal or temporary basis. We did not make any material assumptions, adjustments, or estimates with respect to total compensation. We did not annualize the compensation for any employees. We included non-U.S. employees by converting their total compensation to U.S. Dollars from the applicable local currency. We believe the use of total compensation for all employees is a consistently applied compensation measure because the SEC released guidance providing that compensation determined based on the Company’s tax and/or payroll records is an appropriate consistently applied compensation measure.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS Policies and Procedures for Approval of Related Party Transactions We have adopted a written policy with respect to the review, approval and ratification of related party transactions. Under the policy, our Audit Committee is responsible for reviewing and approving related person transactions. In the course of its review and approval of related party transactions, our Audit Committee considers the relevant facts and circumstances to decide whether to approve such transactions. In particular, our policy requires our Audit Committee to consider, among other factors it deems appropriate: • the related person’s relationship to us and interest in the transaction; • the material facts of the proposed transaction, including the proposed aggregate value of the transaction; • the impact on a director’s independence in the event the related person is a director or an immediate family member of the director or director nominee; • the benefits to us of the proposed transaction; • if applicable, the availability of other sources of comparable products or services; and • an assessment of whether the proposed transaction is on terms that are comparable to the terms available to an unrelated third party or to employees generally. The Audit Committee may only approve those transactions that are in, or are not inconsistent with, our best interests and those of our stockholders, as the Audit Committee determines in good faith. In addition, under our Code of Business Conduct and Ethics, our employees and directors have an affirmative responsibility to disclose any transaction or relationship that reasonably could be expected to give rise to a conflict of interest. All of the transactions described below were entered into prior to the adoption of the Company’s written related party transactions policy, but all such transactions were approved by our Board considering similar factors to those described above. Related Party Transactions Other than compensation arrangements for our directors and named executive officers, which are described in the section entitled “Executive Compensation” elsewhere in this Proxy Statement, below we describe transactions during the year ended December 31, 20212023 through the date of this Proxy Statement to which we were a participant or will be a participant, in which: • the amounts involved exceeded or will exceed $120,000; and • any of our directors, executive officers, or holders of more than 5% of our capital stock, or any member of the immediate family of, or person sharing the household with, the foregoing persons, had or will have a direct or indirect material interest. Agreements and Transactions Related to the Take-Private Transaction

On March 24, 2020, we entered into an advisory services agreementAgreement with our Principal Stockholder pursuant to which we engaged

The Company has agreements in place with our Principal Stockholder as afor financial transactional and management consultant. Under theadvisory services, agreement,along with compensation arrangements and reimbursements to the extent permitted under our credit agreement, we had to reimburse the travel expensesdirectors and out-of-pocket fees and expenses in performing the ongoing services.officers. During the year ended December 31, 2021,2023, we incurred $0.1$0.6 million related to these services. The advisory services agreement was terminated in connection with our IPO. The “Take-Private Transaction” refers to Thoma Bravo’s acquisition of Instructure, Inc., our predecessor, on March 24, 2020.

Employment of a Family Member The spouse of Mitch Benson, our Chief ProductStrategy Officer, iswas formerly an employee of the Company. Mr. Benson has been an employee of the Company since 2014 and our Chief Product Officeran officer of the Company since August 2019. His spouse, Ms. Tara Gunther, has beenwas an employee of the Company since 2014. Her 2021from 2014 until June 2, 2023. For the year ended December 31, 2023, Ms. Gunther's base salary and short-term incentive award was approximately $0.2 million in the aggregate.$0.26 million. She also received benefits generally available to all employees. The compensation for Ms. Gunther was determined in accordance with our standard employment and compensation practices applicable to employees with similar responsibilities and positions.

Director Nomination Agreement In connection with our IPO, we entered intoWe are party to a Director Nomination Agreement with our Principal Stockholder that provides our Principal Stockholder the right to designate nominees for election to our Board for so long as our Principal Stockholder beneficially owns 5% or more of the Original Amount. Our Principal Stockholder may also assign its designation rights under the Director Nomination Agreement to an affiliate (other than a portfolio company of Thoma Bravo). See the section titled “Board of Directors and Corporate Governance—Director Nomination Agreement” included in this Proxy Statement for a description of the Director Nomination Agreement.

Registration Rights Agreement In connection with our IPO, we entered intoWe are party to a registration rights agreement with our Principal Stockholder pursuant to which our Principal Stockholder is entitled to request that we register our Principal Stockholder’s shares on a long-form or short-form registration statement on one or more occasions in the future, which registrations may be “shelf registrations.” Our Principal Stockholder is also entitled to participate in certain of our registered offerings, subject to the restrictions in the registration rights agreement. Certain of our pre-IPO equityholders, including two of our directors (Mr. Akopiantz and Mr. Goodman), are entitled to piggyback on registered offerings initiated by us or by our Principal Stockholder. We will pay our Principal Stockholder’s expenses in connection with our Principal Stockholder’s exercise of these rights. The registration rights described in this paragraph apply to (i) shares of our common stock held by our Principal Stockholder and its affiliates and (ii) any of our capital stock (or that of our subsidiaries) issued or issuable with respect to the common stock described in clause (i) with respect to any dividend, distribution, recapitalization, reorganization, or certain other corporate transactions (“Registrable Securities”). These registration rights are also for the benefit of any subsequent holder of Registrable Securities; provided that any particular securities will cease to be Registrable Securities when they have been sold in a registered public offering, sold in compliance with Rule 144 of the Securities Act of 1933, as amended (the “Securities Act”), or repurchased by us or our subsidiaries. In addition, with the consent of the companyCompany and holders of a majority of Registrable Securities, any Registrable Securities held by a person other than our Principal Stockholder and its affiliates will cease to be Registrable Securities if they can be sold without limitation under Rule 144 of the Securities Act.

Indemnification of Officers and Directors Upon completion of our IPO, weWe previously entered into indemnification agreements with each of our executive officers and directors. The indemnification agreements provide the executive officers and directors with contractual rights to indemnification, expense advancement and reimbursement, to the fullest extent permitted under the DGCL.General Corporation Law of the State of Delaware (“DGCL”). Additionally, we may enter into indemnification agreements with any new directors or officers that may be broader in scope than the specific indemnification provisions contained in Delaware law.

Term Loan

From time to time, entities affiliated with our Principal Stockholder may acquire loans incurred by us either from us, in open market transactions or through loan syndications. On March 24, 2020, we entered into a credit agreement (“Credit Agreement”) with a syndicate of lenders which provided for a senior secured loan facility (as amended, the “Term Loan”). In connection with our entry into our credit facilities on March 24, 2020, affiliates of our Principal Stockholder collectively acquired $129.2 million of our Term Loan. In connection with our principal prepayments made in August 2021, $42.5 million of the prepayments were applied to the Term Loan held by affiliates of our Principal Stockholder. Additionally, in connection with our October 29, 2021 refinancing of indebtedness under the Credit Agreement, $88.6 million of the Term Loan held by affiliates of our Principal Stockholder was paid off. Interest paid to affiliates of our Principal Stockholder for the year ended December 31, 2021 was $7.5 million.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table sets forth information about the beneficial ownership of our common stock as of April 5, 20224, 2024 for: • each person or group known to us who beneficially owns more than 5% of our common stock; • each of our Named Executive Officers; and • all of our directors and executive officers as a group. The numbers of shares of common stock beneficially owned and percentages of beneficial ownership are based on 141,347,146145,927,863 shares of common stock outstanding as of April 5, 2022.4, 2024. Beneficial ownership for the purposes of the following table is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. Common stock subject to options or restricted stock units (“RSUs”) that are currently exercisable or exercisable or will vest within 60 days of April 5, 20224, 2024 are deemed to be outstanding and beneficially owned by the person holding the options or RSUs. These shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as disclosed in the footnotes to this table and subject to applicable community property laws, we believe that each stockholder identified in the table possesses sole voting and investment power over all common stock shown as beneficially owned by the stockholder. Unless otherwise noted below, the address of each beneficial owner listed on the table is c/o Instructure Holdings, Inc., 6330 South 3000 East, Suite 700, Salt Lake City, UT 84121. | | | | | | | | | Name of Beneficial Owner | | Number of Shares of Common Stock

Beneficially

Owned | | | Percentage of

Shares of Common Stock

Outstanding | | 5% Stockholders | | | | | | | Thoma Bravo(1) | | | 122,065,804 | | | 83.6% | | Named Executive Officers and Directors | | | | | | | Steve Daly(2) | | | 1,510,750 | | | 1.0% | | Peter Walker | | | — | | | | — | | Chris Ball(3) | | | 53,352 | | | * | | Matthew A. Kaminer(4) | | | 298,760 | | | * | | Mitch Benson(5) | | | 115,205 | | | * | | Dale Bowen(6) | | | 587,000 | | | * | | Charles Goodman(7) | | | 118,552 | | | * | | Erik Akopiantz | | | 38,497 | | | * | | Ossa Fisher(8) | | | 22,500 | | | * | | Lloyd Waterhouse(9) | | | 31,773 | | | * | | James Hutter | | | — | | | | — | | Brian Jaffee | | | — | | | | — | | Paul Holden Spaht, Jr. | | | — | | | | — | | All Directors and Executive Officers as a Group (12 individuals)(10) | | | 2,189,389 | | | 1.5% | |

* Indicates less than 1%

(1)As reported on the Schedule 13G filed on February 4, 2022, consists of 1,073,324 shares held directly by Thoma Bravo Executive Fund XIII, L.P. (“TB Exec Fund”), 56,619,128 shares held directly by Thoma Bravo Fund XIII, L.P. (“TB Fund XIII”), and 64,373,352 shares held directly by Thoma Bravo Fund XIII-A, L.P. (“TB Fund XIII-A”). Thoma Bravo Partners XIII, L.P. (“TB Partners XIII”) is the general partner of each of TB Exec Fund, TB Fund XIII and TB Fund XIII-A. Thoma Bravo is the ultimate general partner of TB Partners XIII. Thoma Bravo’s voting and investment decisions are made by an investment committee comprised of Seth Boro, Orlando Bravo, S. Scott Crabill, Lee Mitchell, Holden Spaht and Carl Thoma. By virtue of the relationships described in this footnote, Thoma Bravo may be deemed to exercise voting and dispositive power with respect to the shares held directly by TB Exec Fund, TB Fund XIII and TB Fund XIII-A. Messrs. Boro, Bravo, Crabill, Mitchell, Spaht and Thoma disclaim beneficial ownership of the shares held directly by TB Exec Fund, TB Fund XIII, and TB Fund XIII-A. The principal business address of the entities identified herein is c/o Thoma Bravo, L.P., 150 North Riverside Plaza, Suite 2800, Chicago, Illinois 60606. (2)Includes 140,342 RSUs that vest within 60 days of April 4, 2024. (3)Includes 20,752 RSUs that vest within 60 days of April 4, 2024. (4)Includes 15,518 RSUs that vest within 60 days of April 4, 2024. (5)Includes 15,989 RSUs that vest within 60 days of April 4, 2024. (6)The number of shares of common stock beneficially owned is based on Mr Bowen's Form 4 filed on September 6, 2023. The Company does not have more recent information as Mr. Bowen departed from the Company on November 12, 2023. (7)Includes 74,444 shares of common stock pledged to secure bank borrowings. (8)Includes 7,500 RSUs that vest within 60 days of April 4, 2024. (9)Includes 6,550 RSUs that vest within 60 days of April 4, 2024. (10)Includes 206,651 RSUs that vest within 60 days of April 4, 2024.

| | | | | | | | | Name of Beneficial Owner | | Number of Shares

Beneficially

Owned | | | Percentage of

Shares

Outstanding | | 5% Stockholders | | | | | | | | | Thoma Bravo(1) | | | 122,065,804 | | | | 86.4 | % | Named Executive Officers and Directors | | | | | | | | | Steve Daly(2) | | | 1,224,622 | | | | | * | Dale Bowen(3) | | | 297,611 | | | | | * | Matthew A. Kaminer(4) | | | 226,674 | | | | | * | Frank Maylett(5) | | | 125,135 | | | | | * | Mitch Benson(6) | | | 121,131 | | | | | * | Charles Goodman(7) | | | 156,602 | | | | | * | Erik Akopiantz(8) | | | 47,917 | | | | | * | Ossa Fisher(9) | | | 15,000 | | | | | * | Lloyd Waterhouse(10) | | | 13,102 | | | | | * | James Hutter | | | — | | | | — | | Brian Jaffee | | | — | | | | — | | Paul Holden Spaht, Jr. | | | — | | | | — | | All Directors and Executive Officers as a Group (13 individuals)(11) | | | 2,317,823 | | | | 1.6 | % |

(1) | Consists of 1,073,324 shares held directly by Thoma Bravo Executive Fund XIII, L.P. (“TB Exec Fund”), 56,619,128 shares held directly by Thoma Bravo Fund XIII, L.P. (“TB Fund XIII”), and 64,373,352 shares

|

| held directly by Thoma Bravo Fund XIII-A, L.P. (“TB Fund XIII-A”). Thoma Bravo Partners XIII, L.P. (“TB Partners XIII”) is the general partner of each of TB Exec Fund, TB Fund XIII and TB Fund XIII-A. Thoma Bravo is the ultimate general partner of TB Partners XIII. Thoma Bravo’s voting and investment decisions are made by an investment committee comprised of Seth Boro, Orlando Bravo, S. Scott Crabill, Lee Mitchell, Holden Spaht and Carl Thoma. By virtue of the relationships described in this footnote, Thoma Bravo may be deemed to exercise voting and dispositive power with respect to the shares held directly by TB Exec Fund, TB Fund XIII and TB Fund XIII-A. Messrs. Boro, Bravo, Crabill, Mitchell, Spaht and Thoma disclaim beneficial ownership of the shares held directly by TB Exec Fund, TB Fund XIII, and TB Fund XIII-A. The principal business address of the entities identified herein is c/o Thoma Bravo, L.P., 150 North Riverside Plaza, Suite 2800, Chicago, Illinois 60606. |

(2) | Includes 89,813 RSUs that vest within 60 days of April 5, 2022.

|

(3) | Includes 26,291 RSUs that vest within 60 days of April 5, 2022.

|

(4) | Includes 14,573 RSUs that vest within 60 days of April 5, 2022.

|

(5) | Includes 15,049 RSUs that vest within 60 days of April 5, 2022.

|

(6) | Includes 14,930 RSUs that vest within 60 days of April 5, 2022.

|

(7) | Includes 10,778 RSUs that vest within 60 days of April 5, 2022.

|

(8) | Includes 2,874 RSUs that vest within 60 days of April 5, 2022.

|

(9) | Includes 7,500 RSUs that vest within 60 days of April 5, 2022.

|

(10) | Includes 6,551 RSUs that vest within 60 days of April 5, 2022.

|

(11) | Includes 198,564 RSUs that vest within 60 days of April 5, 2022.

|

COMPENSATION COMMITTEE REPORT Our Compensation and Nominating Committee oversees director and officer compensation and similar plans. Our Principal Stockholder controls a majority of our outstanding stock. As a result, we are a “controlled company” and rely on the NYSE rules which provide that a controlled company may elect not to comply with certain corporate governance standards required of newly public companies, including the requirement to have a compensation committee that is composed of entirely independent directors within one year of the listing date. We rely on our exemption as a “controlled company.” As provided in the Compensation and Nominating Committee Charter, the Committee’s primary responsibility is to (i) review and approve corporate goals and objectives relevant to the compensation of our Chief Executive Officer, (ii) evaluate the performance of our Chief Executive Officer in light of such corporate goals and objectives, (iii) review and approve the compensation of our other executive officers and (iv) establish our overall management compensation, philosophy and policy. The Compensation and Nominating Committee has reviewed and discussed the Company’s Compensation Discussion and Analysis section in this Proxy Statement with management. Based upon such review and discussions, the Compensation and Nominating Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.2023. Compensation and Nominating Committee: Charles Goodman, Chair Paul Holden Spaht, Jr. Brian Jaffee

PROPOSAL 2 — ADVISORY VOTE REGARDING RETENTION OF THE CLASSIFIED STRUCTURE OF OUR BOARD Background of the Proposal

In accordance with our Charter, and as permitted under the DGCL, our Board is divided into three classes. Our current classified Board structure has been in place since our IPO. At each annual meeting of stockholders, commencing with this 2022 Annual Meeting, each director is elected to serve a term of three years, with each director’s term expiring at the third succeeding annual meeting of stockholders held after the director’s election. The directors designated as Class I have terms expiring at this 2022 Annual Meeting; the directors designated as Class II have terms expiring at the 2023 Annual Meeting of Stockholders; and the directors designated as Class III have terms expiring at the 2024 Annual Meeting of Stockholders.

At the time of our IPO, the Board believed that a classified Board structure was an important piece of the Company’s governance structure in order to promote continuity and stability, and was in the best interests of the Company and its stockholders. The Board also believed that the classified Board structure would protect the Company against unfair or abusive takeover practices following the IPO and, given the nature of the Company (as discussed in more detail below), protect the long-term value of the Company. At the same time, the Board recognized that some investors may view classified boards as having the effect of reducing the accountability of directors to stockholders because classified boards limit the ability of stockholders to elect all directors on an annual basis. Accordingly, at this Annual Meeting, the Company is asking our stockholders to vote, on an advisory basis, on whether to retain the classified Board structure.

If this proposal is approved by the holders of a majority of shares of the Company’s common stock voting on the proposal at the Annual Meeting, then the Company will retain a classified Board. However, if a majority of shares of the Company’s common stock voting on the proposal at the Annual Meeting vote against the proposal, then this proposal would not by itself declassify or begin the declassification of the Board. Instead, rejection of the proposal would only advise the Board that a majority of our stockholders voting at the Annual Meeting desire to end the classified Board structure. Consistent with its fiduciary duties, if stockholders vote against this proposal, the Board will reevaluate its position with respect to our classified Board structure. This reevaluation would include considering the percentage of stockholders voting against this proposal.

If a majority of our stockholders vote against this proposal and the Board determines that the declassification of the Board is in the best interests of the Company and its stockholders, then the Board will include a proposal in the proxy statement for the 2023 Annual Meeting of Stockholders to amend the Charter to declassify the Board. Such an amendment must be approved by the Board and then by the affirmative vote of not less than 50% of the then-outstanding shares of the Company entitled to vote at a duly held meeting (or 662⁄3% if our Principal Stockholder owns, in the aggregate, less than 50% in voting power of the stock of the Company entitled to vote generally in the election of directors).

We expect that such amendment to the Charter would provide for a phased-in elimination of the classified structure of the Board over a three-year period commencing with the 2024 Annual Meeting of Stockholders. To comply with DGCL, the amendment to the Charter would not change the unexpired three-year terms of directors elected prior to the effectiveness of the amendment (including directors elected at the 2022 and 2023 Annual Meetings of Stockholders). This would result in the Board being fully declassified (and all Board members standing for annual elections) commencing with the 2026 Annual Meeting of Stockholders.

If a decision were made to declassify the Board, starting at the 2024 Annual Meeting of Stockholders, directors would be elected to one-year terms, and until their successors are duly elected and qualified. Therefore, beginning with the 2026 Annual Meeting of Stockholders, the entire Board would stand for election.

Board’s Recommendation to Stockholders

The Board regularly reviews the corporate governance policies and practices of the Company to determine whether they are appropriate and will advance the Board’s and management’s goal of maximizing long-term stockholder value. As part of that review, the Board considered whether the Board’s current structure continues to be advisable. The Board evaluated both the advantages and disadvantages of maintaining a classified Board structure, and determined that the classified Board structure continues to be in the best interests of the Company and our stockholders following the IPO for the reasons set forth below:

Long-Term Strategic Perspective and Consistency with Investment Horizons. The Board believes that the Company’s current Board structure allows the directors to develop a deeper familiarity with the Company’s business following the IPO and encourages long-term strategic thinking, which enhances long-term stockholder value. Thus, the Board believes three-year terms on a staggered basis are appropriate and consistent with an investment horizon for a company such as ours, and that our stockholders are best served by director terms that reflect the long-term nature of our business.

Continuity and Stability from Institutional Knowledge. The Board believes, as it did at the time of the IPO, that three-year terms promote continuity and foster an appropriate institutional memory among directors and a deep knowledge of the business, strategy and competitive environment. Experienced directors who are knowledgeable about the Company’s regulated and complex business environment are a valuable resource and are better positioned to make decisions that are in the best interests of the Company and our stockholders. Staggered terms give the Company’s new directors an opportunity to gain knowledge about the Company’s business and strategy from its continuing directors. If all directors were elected annually, the Board could be composed entirely of directors who were unfamiliar with the Company and its business strategies. This could jeopardize our long-term strategies and growth plans.

Accountability to Stockholders. Under the DGCL, all our directors are required to uphold their fiduciary duties to our stockholders, regardless of how often they stand for election. Under our classified Board structure, a majority of directors will stand for election during any three-year period. The Board has implemented broad measures to ensure accountability of our directors, including the adoption of our Code of Ethics. In addition, the Board requires an annual self-assessment of the performance of the Board and its committees, which is led by the Compensation and Nominating Committee. This committee also considers the performance of each current director when determining whether or not to recommend the nomination of such director for an additional term. Additionally, any director, or the entire Board, may be removed from office if there is “cause” for removal, subject to the terms of the Charter. As a result, the Company benefits from the stability and continuity of a classified Board structure, while retaining meaningful director accountability.

Protecting Stockholder Value in the Event of an Unsolicited Acquisition Offer. The Company’s current Board structure reduces its vulnerability to potentially unfair and abusive takeover tactics and encourages potential acquirers to negotiate with the Board. The Board believes that the classified Board structure may improve the relative bargaining power of the Company on behalf of its stockholders by providing leverage to negotiate for higher value bids or pursue third party suitors who may be able to offer a higher value. A classified board structure does not preclude unsolicited acquisition proposals. However, by eliminating the threat of imminent removal, it allows the Board to maximize the value of a potential acquisition by giving the Company time and bargaining leverage to evaluate and negotiate the adequacy and fairness of any takeover proposal and to consider alternatives, including the continued operation of the Company’s business.

THE BOARD RECOMMENDS THAT YOU VOTE, ON AN ADVISORY BASIS, “FOR” THE RETENTION OF OUR CLASSIFIED BOARD STRUCTURE.

PROPOSAL 3 — ADVISORY VOTE REGARDING RETENTION OF THE SUPERMAJORITY VOTING STANDARDS IN OUR CHARTER AND BYLAWS

Background of the Proposal

Our Charter and Bylaws provide that our Board is expressly authorized to make, alter, amend, change, add to, rescind or repeal, in whole or in part, our Bylaws without a stockholder vote in any matter not inconsistent with the DGCL and our Charter. For as long as our Principal Stockholder beneficially owns, in the aggregate, at least 50% in voting power of the stock of the Company entitled to vote generally in the election of the directors, any amendment, alteration, rescission or repeal of our Bylaws by our stockholders will require the affirmative vote of a majority in voting power of the outstanding shares of our stock entitled to vote on such amendment, alteration, change, addition, rescission or repeal. At any time when our Principal Stockholder beneficially owns, in the aggregate, less than 50% in voting power of all outstanding shares of the stock of the Company entitled to vote generally in the election of directors, any amendment, alteration, rescission or repeal of our Bylaws by our stockholders will require the affirmative vote of the holders of at least 662⁄3% in voting power of all the then-outstanding shares of stock of the Company entitled to vote thereon, voting together as a single class.

The DGCL provides generally that the affirmative vote of a majority of the outstanding shares entitled to vote thereon, voting together as a single class, is required to amend a corporation’s certificate of incorporation, unless the certificate of incorporation requires a greater percentage.

Our Charter provides that at any time when our Principal Stockholder beneficially owns, in the aggregate, less than 50% in voting power of the stock of the Company entitled to vote generally in the election of directors, the following provisions in our Charter may be amended, altered, repealed or rescinded only by the affirmative vote of the holders of at least 662⁄3% (as opposed to a majority threshold that would apply if our Principal Stockholder beneficially owns, in the aggregate, 50% or more) in voting power of all the then-outstanding shares of stock of the Company entitled to vote thereon, voting together as a single class:

| • | | the provisions requiring a 662⁄3% supermajority vote for stockholders to amend our Bylaws;

|

the provisions providing for a classified Board (the election and term of our directors);

the provisions regarding resignation and removal of directors;

the provisions regarding entering into business combinations with interested stockholders;

the provisions regarding stockholder action by written consent;

the provisions regarding calling special meetings of stockholders;

the provisions regarding filling vacancies on our Board and newly created directorships;

the provisions eliminating monetary damages for breaches of fiduciary duty by a director;

the provisions providing for the Court of Chancery of the State of Delaware as the exclusive forum for certain actions, including derivative actions and claims of breaches of fiduciary duties; and

| • | | the amendment provision requiring that the above provisions be amended only with a 662⁄3% supermajority vote.

|

In addition, our Charter provides that directors may be removed with or without cause upon the affirmative vote of a majority in voting power of all outstanding shares of stock entitled to vote thereon, voting together as a single class; provided, however, at any time when our Principal Stockholder beneficially owns, in the aggregate, less than 40% in voting power of the stock of the Company entitled to vote generally in the election of directors, directors may only be removed for cause, and only by the affirmative vote of holders of at least 662⁄3% in voting power of all the then-outstanding shares of stock of the Company entitled to vote thereon, voting together as a single class.

At the time of our IPO, the Board believed that the supermajority voting standards under our Charter and Bylaws were an important piece of the Company’s governance structure to safeguard the long-term interests of the Company and its stockholders once our Principal Stockholder no longer hold a majority of our shares. At the same time, the Board recognized that some investors may view the supermajority voting standards as a means of blocking initiatives supported by stockholders, but blocked by a status quo management. Accordingly, at the Annual Meeting, the Company is asking our stockholders to vote, on an advisory basis, on whether to retain the supermajority voting standards.

If this proposal is approved by the holders of a majority of shares of the Company’s common stock voting on the proposal at the Annual Meeting, then the Company will retain the supermajority voting standards. If a majority of shares of the Company’s common stock voting on the proposal at the Annual Meeting vote against the proposal, then this result would not by itself remove the supermajority voting standards. Instead, rejection of the proposal would only advise the Board that a majority of our stockholders voting at the Annual Meeting desire to eliminate the supermajority voting standards. Consistent with its fiduciary duties, if stockholders vote against this proposal, the Board will reevaluate its position with respect to the retention of the supermajority voting standards. This reevaluation would include considering the percentage of stockholders voting against this proposal. If stockholders representing less than 50% of outstanding common stock reject this proposal, then the Board will likely not take additional steps.

If a majority of our stockholders vote against this proposal and the Board determines that the elimination of the supermajority voting standards is in the best interests of the Company and its stockholders, then the Board will include a proposal in the proxy statement for the 2023 Annual Meeting of Stockholders to amend our Charter and Bylaws to eliminate the supermajority voting standards. An amendment to the Charter and Bylaws must first be approved by the Board and then approved by the affirmative vote of not less than 50% of the then-outstanding shares of the Company entitled to vote at a duly held meeting (or 662⁄3% if our Principal Stockholder owns, in the aggregate, less than 40% in voting power of the stock of the Company entitled to vote generally in the election of directors). If such amendment were approved, the Charter and Bylaws would be amended immediately thereafter to remove the supermajority voting standards.

Board’s Recommendation to Stockholders

The Board regularly reviews the corporate governance policies and practices of the Company to determine whether they are appropriate and will advance the Board’s and management’s goal of maximizing long-term stockholder value. As part of that review, the Board considered whether retention of the supermajority voting standards continues to be advisable. The Board evaluated both the advantages and disadvantages of maintaining the supermajority voting standards, and determined that retaining the supermajority voting standards continues to be in the best interests of the Company and our stockholders following the IPO for the following reasons:

the supermajority voting standards under our Charter and Bylaws are appropriately limited with application only to extraordinary transactions and fundamental changes to corporate governance;

Delaware law permits supermajority voting requirements and a number of publicly-traded companies similar to ours have adopted these provisions to preserve and maximize long-term value for all stockholders;

the Board believes that the supermajority vote requirements protect stockholders, particularly minority stockholders, against the potentially self-interested actions of short-term investors and, without these provisions, it would be possible for a group of short-term stockholders to approve an extraordinary transaction that is not in the best interest of the Company and opposed by nearly half of the Company’s stockholders;

these provisions mitigate the risks presented by a group of short-term stockholders, who may (i) only own their shares as of a voting record date or may have hedged their economic exposure and (ii) act in their own self-interests to the detriment of other stockholders;

these supermajority voting requirements encourage potential acquirers to deal directly with the Board, which in turn enhances the Board’s ability to consider the long-term interests of all stockholders; and

these supermajority voting requirements protect the ability of the Board to evaluate proposed offers, to consider alternatives, and to protect stockholders against abusive tactics during a takeover process.

THE BOARD RECOMMENDS THAT YOU VOTE, ON AN ADVISORY BASIS, “FOR” THE RETENTION OF THE SUPERMAJORITY VOTING STANDARDS IN OUR CHARTER AND BYLAWS.

PROPOSAL 4 — ADVISORY VOTE REGARDING NAMED EXECUTIVE OFFICER COMPENSATION (“SAY-ON-PAY”)

Pursuant to Section 14A of the Exchange Act, we are asking our stockholders to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with SEC rules. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement. The compensation of our named executive officers is disclosed in the Compensation Discussion and Analysis, the compensation tables and the related narrative disclosure contained elsewhere in this Proxy Statement. As discussed in those disclosures, the Compensation and Nominating Committee and the Board believe that our compensation policies and decisions are appropriately designed to align the interests of our named executive officers with those of our stockholders, to emphasize strong pay-for-performance principles and to enable us to attract and retain talented and experienced executives to lead the Company in a competitive environment. The Board is asking stockholders to support the compensation of the Company’s named executive officers as described in this Proxy Statement by casting a non-binding advisory vote “FOR” the following resolution: ”RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 20222024 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 20212023 Summary Compensation Table and the other related tables and disclosure.” While the advisory vote we are asking you to cast is non-binding, the Compensation and Nominating Committee and the Board value the views of our stockholders and will take into account the outcome of the vote when considering future compensation decisions for our executive officers. THE BOARD RECOMMENDS YOU VOTE, ON AN ADVISORY BASIS, “FOR” THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS PRESENTED IN THIS PROXY STATEMENT.

PROPOSAL 5 — ADVISORY VOTE REGARDING SAY-ON-PAY FREQUENCY Section 14A of the Exchange Act enable the Company’s stockholders, at least once every six years, to indicate their preference regarding how frequently the Company should solicit a say-on-payvote/non-binding advisory vote on the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement (a so-called“say-on-pay” vote). The Company is asking its stockholders to indicate whether they would prefer an advisory vote every year, every other year or every three years. Alternatively, stockholders may abstain from casting a vote. For the reasons described below, the Board recommends that the stockholders select a frequency of every year.

Although we recognize the potential benefits of having less frequent advisory votes on named executive officer compensation (including allowing the Company additional time to conduct a more detailed review of its compensation practices in response to the outcome of stockholder advisory votes), we recognize that the widely adopted standard, both among our peer companies as well as outside our industry, is to hold “say-on-pay” votes annually. We also acknowledge current stockholder expectations regarding having the opportunity to express their views on the Company’s compensation of its named executive officers on an annual basis. In light of investor expectations and prevailing market practice, the Board recommends that the advisory vote on named executive officer compensation occur every year.

The proxy card provides for four choices and stockholders are entitled to vote on whether the advisory vote on named executive officer compensation should be held every year, every two years or every three years, or to abstain from voting.

The result of this advisory vote on the frequency of the vote on named executive officer compensation is not binding on the Company, the Board or the Compensation and Nominating Committee, and will not be construed as overruling a decision by the Company, the Board or the Compensation and Nominating Committee or creating or implying any additional fiduciary duty for the Company, the Board or the Compensation and Nominating Committee. However, the Board values the opinions that stockholders express in their votes. The Board will consider the outcome of the vote and stockholder feedback when deciding how frequently to conduct the advisory vote on named executive officer compensation. Notwithstanding the Board’s recommendation and the outcome of the stockholder vote, the Board may in the future decide to conduct “say-on-pay” votes on a more or less frequent basis and may vary its practice based on factors such as discussions with stockholders and the adoption of material changes to its executive compensation programs.

THE BOARD RECOMMENDS A VOTE TO HOLD THE ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION EVERY YEAR

PROPOSAL 63 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022.2024. Services provided to the Company and its subsidiaries by Ernst & Young LLP for the year ended December 31, 20212023 are described below and under “Audit Committee Report.” Fees and Services The following table summarizes the aggregate fees for professional audit services and other services rendered by Ernst & Young LLP for the years ended December 202131, 2023 and 2020:2022: | | | | | | | | | | | 2023(5) | | | 2022 | | Audit Fees(1) | | $ | 1,901,242 | | | $ | 1,806,118 | | Audit-Related Fees(2) | | | 1,692,841 | | | | 1,347,284 | | Tax Fees(3) | | | - | | | | 58,726 | | All Other Fees(4) | | | 303,600 | | | | 860,620 | | Total | | $ | 3,897,683 | | | $ | 4,072,748 | |

(1)Consist of fees for the audit and other procedures in connection with our Annual Report on Form 10-K and review of our quarterly financial statements in connection with our Quarterly Reports on Form 10-Q. This category also includes fees for services associated with documents filed with the SEC and in connection with securities offerings, and accounting consultation and research work necessary to comply with financial reporting and accounting standards. (2)Consist of fees billed for assurance and related services not reported under Audit Fees that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements, including due diligence related to mergers and acquisitions. (3)Consist of review of tax related items, including transfer pricing and Section 382 analysis. (4)Consist of fees billed for market studies, as well as fees for subscriptions to Ernst & Young LLP’s accounting research tool. (5)Fees exclude professional audit services and other services where EY was engaged by PCS Holdings, LLC (“Parchment”) prior to the acquisition by the Company. | | | | | | | | | | | | 2021 | | | 2020 | | Audit Fees(1) | | $ | 2,620,308 | | | $ | 377,070 | | Audit-Related Fees(2) | | | 1,361,702 | | | | 1,353,842 | | Tax Fees(3) | | | 203,969 | | | | 158,043 | | All Other Fees(4) | | | 877,515 | | | | 603,308 | | | | | | | | | | | Total | | $ | 5,063,494 | | | $ | 2,492,263 | | | | | | | | | | |

(1) | Consist of fees for the audit and other procedures in connection with the Annual Report on Form 10-K for the year ended December 31, 2021, review of our interim financial statements in 2021, certain procedures conducted in connection with the IPO, services rendered in connection with the filing of our registration statements, the issuance of comfort letters and consents, and the audit of our financial statements for the year ended December 31, 2020.

|

(2) | Consist of fees billed for assurance and related services not reported under Audit Fees that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements, including accounting consultations in connection with transactions and merger and acquisition due diligence.

|

(3) | Consist of review of tax related items, including transfer pricing, 382 analysis, transaction cost analysis and international entity structuring.

|

(4) | Consist of fees billed for market studies performed on behalf of management, as well as fees for subscriptions to Ernst & Young LLP’s accounting research tool.

|

In considering the nature of the services provided by the independent registered public accounting firm, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with the independent registered public accounting firm and the Company’s management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the Public Company Accounting Oversight Board. The Audit Committee has adopted a policy that requires advance approval of all audit services as well as non-audit services performed by our independent registered public accounting firm. The term of any pre-approval is twelve months from the date of pre-approval, unless specified otherwise. Accordingly, unless the specific service has been pre-approved with respect to that year, the Audit Committee must approve the permitted service before the independent registered public accounting firm is engaged to perform such services. Each year, the Audit Committee will pre-approve audit services, audit-related services and tax services to be used by the Company. The Audit Committee approved all services provided by Ernst & Young LLP. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so, and we expect that they will be available to respond to questions.

Ratification of the appointment of Ernst & Young LLP requires the affirmative votes from the holders of a majority of the sharesvoting power of the capital stock present in person or represented by proxy at the Annual Meeting and entitled to vote.vote thereon. If the Company’s stockholders do not ratify the appointment of Ernst & Young LLP, the Audit Committee will reconsider the appointment and may affirm the appointment or retain another independent accounting firm. Even if the appointment is ratified, the Audit Committee may in the future replace Ernst & Young LLP as our independent registered public accounting firm if it is determined that it is in the Company’s best interests to do so. THE AUDIT COMMITTEE AND THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2022.2024.

AUDIT COMMITTEE REPORT(1) The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 20212023 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed pursuant to applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by PCAOB Ethics and Independence Rule 3526, Communications with Audit Committees Concerning Independence, regarding the auditor’s independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021.2023. Audit Committee: Erik Akopiantz, Chair Ossa Fisher Lloyd Waterhouse (1) The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. (1) | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

OTHER MATTERS We are not aware of any matters other than those discussed in the foregoing materials contemplated for action at the Annual Meeting. The persons named in the proxy card will vote in accordance with the recommendation of the Board on any other matters incidental to the conduct of, or otherwise properly brought before, the Annual Meeting. The proxy card contains discretionary authority for them to do so.

WHERE TO FIND ADDITIONAL INFORMATION We are subject to the informational requirements of the Exchange Act and in accordance therewith, we file annual, quarterly and current reports and other information with the SEC. Such information may be accessed electronically by means of the SEC’s home page on the Internet at www.sec.gov. We are an electronic filer, and the SEC maintains an Internet site at www.sec.gov that contains the reports and other information we file electronically. These filings are also available on our corporate website at https://ir.instructure.com. Please note that our website address is provided as an inactive textual reference only and the information provided on or accessible through our website is not part of this Proxy Statement. We make available free of charge, through our website, our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. A paper copy of the annual report on Form 10-K including financial statements and financial statement schedules, but without exhibits, is also available without charge to stockholders upon written request to: 6330 South 3000 East, Suite 700, Salt Lake City, UT, 84121, Attn: Matthew A. Kaminer, Corporate Secretary. Copies of any exhibit will be forwarded upon written request, subject to a reasonable charge for copying and mailing.

COST OF PROXY SOLICITATION The Company is paying the expenses of this solicitation. The Company will also make arrangements with brokerage houses and other custodians, nominees and fiduciaries to forward proxy materials to beneficial owners of stock held as of the Record Date by such persons, and the Company will reimburse such persons for their reasonable out-of-pocket expenses in forwarding such proxy materials. In addition to solicitation by mail, directors, officers and other employees of the Company may solicit proxies in person or by telephone, facsimile, email or other similar means.

| | | | | | | | | | | | |  |

|

| SCAN TO

VIEW MATERIALS & VOTE

| |

|

| | | | |

| | | | | | VOTE BY INTERNET – www.proxyvote.com or scan the QR Barcode above | | | INSTRUCTURE HOLDINGS, INC.

6330 SOUTH 3000 EAST, SUITE 700

SALT LAKE CITY, UTAH 84121 | | VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode aboveUse the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 P.M. ET on May 25, 2022.22, 2024. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

|

| ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. |

| VOTE BY PHONE -– 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 P.M. ET on May 25, 2022.22, 2024. Have your proxy card in hand when you call and then follow the instructions. |

| VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| | | | | | | TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | | | KEEP THIS PORTION FOR YOUR RECORDS | — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

| DETACH AND RETURN THIS PORTION ONLY | THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. | | DETACH AND RETURN THIS PORTION ONLY |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | The Board of Directors recommends you vote FOR

each of the | | | | | | | | | | | | | | | | director nominees below: |

|

|

| | | | | | | |

| | | |

|

|

|

|

|

| 1. | Election of Class IIII Directors Nominees

|

| For

|

| | | Withhold | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 1a. Charles Goodman

| |  | | | |  | | | | | | The Board of Directors recommends you

vote 1 YEAR on proposal 5.

|

|

| 1 year

|

| 2 years | | 3 years | | Abstain | | | | | | | | | | | | | | | |

|

| | | | 1b. Ossa Fisher

| |  | | | |  | | | | | | 5. To recommend, by a non-binding advisory vote, the frequency of future advisory votes on executive compensation

(“say-on-pay frequency”)

| Nominees | For |

| Withhold |  | |  | |  | |

| | |

| 1c. Paul Holden Spaht, Jr.

|

|

| | |

|

| | | | | | | | | | | | | | | | | 1a. | Steve Daly | |

| |

|

|

|

|

|

|

| 1b. | Brian Jaffee | |

| |

|

|

|

|

|

|

| 1c. | Lloyd “Buzz” Waterhouse | |

| |

|

|

|

|

|

|

| The Board of Directors recommends you vote FOR

proposals 2 and 3. | | | | | | | For | The Board of Directors recommends you vote FORAgainst

| Abstain | | | | | | |

|

|

|

| proposals 2, 3 and 4.

|

| For | | Against | | Abstain | | | | | | proposal 6. | | | | | | | | For | | Against | | Abstain | |

| | | 2. | 2.To approve, by an advisory vote, the retention

compensation of our named executive officers,

as disclosed in the classified structure of the Company’s Board of DirectorsProxy Statement

(“say-on-pay”).

| |

| |

|

|

|

| | | | |

|

| 6.

| 3. | To ratify of the appointment of Ernst & Young LLP

as the Company’s independent registered public

accounting firm for the year ending December 31, 20222024. | |

| |

| |

| | | | |

| 3. To approve, by an advisory vote, the retention of the supermajority voting standards in the Company’s Second Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws

|

|

|

|

|

|

|

| | | | |

|

|

|

NOTE:NOTE: Such other business as may properly come before the meeting or any adjournment or postponement thereof.

| | | | | | | | | | | | 4. To approve, by an advisory vote, the compensation of our named executive officers, as disclosed in the Proxy Statement

(“say-on-pay”)

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Signature [PLEASE SIGN WITHIN BOX] | Date | Date

| | | | | | | | | | Signature (Joint Owners) | | | Date | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Annual Report and Notice and Proxy Statement are available for viewing electronically at www.proxyvote.com

| | | | | — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — ��� — — — — — — |

| | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The Notice and Proxy Statement and Form 10-K are available at www.proxyvote.com

|

|

|

|

INSTRUCTURE HOLDINGS, INC.

Annual Meeting of Stockholders

May 26, 202223, 2024 10:00 AM MT

This proxy is solicited by the Board of Directors

The stockholder(s) hereby appoint(s) Dale BowenPeter Walker and Matt Kaminer, or either of them, as proxies, each with the power to appoint his substitute, and herebyherby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of common stock of INSTRUCTURE HOLDINGS, INC. that the stockholder(s) is/are entitled to vote at the Annual Meeting of Stockholders to be held at 10:00 AM MT on May 26, 2022,23, 2024, at Instructure Holdings, Inc., 6330 South 3000 East, Suite 700, Salt Lake City, Utah 84121, and any adjournment or postponement thereof. This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors’ recommendations. If any other matters properly come before the meeting that are not specifically set forth on the proxy card and in the Proxy Statement, the proxies will vote in their discretion. Please refer to the Proxy Statement for a discussion of the Proposals.

Continued and to be signed on reverse side

|

|